How the Federal Reserve Built a Housing Market of Cards and Destroyed the American Dream to Enrich Wall Street

FED had no clear authority for $2.7 Trillion in illicit residential mortgage-backed securities and refuses to cease purchases despite record inflation and unaffordability

A home is the largest purchase most Americans make in their lifetimes. Buying a home is a critical step for families to lay down roots and create some semblance of community, stability and financial security. In many ways, it is the foundation to a well-functioning, stable society. It should be very distressing to everyone that U.S. housing affordability has now literally reached the least affordable ever on record.

For officials at the Federal Reserve and their cronies on Wall Street, however, the U.S. housing market is just another opportunity to exploit and financialize. They don’t give a flying fuck about building communities or how the Fed’s boom-bust policy is destroying their fellow countrypeople. It’s just a game of numbers and seeing how much they can get away with squeezing hardworking Americans with ever-higher rents and mortgages.

Fed-Wall Street corruption — especially with respect to the U.S. housing market — was on full display during the Global Financial Crisis. Wall Street took massive quantities of risky subprime mortgages and bundled them into derivatives called mortgage-backed securities (MBS). The FED and other US government agencies turned a blind eye to the risk. And we all know the result: when MBS began to fail, the entire world’s economy imploded for years.

The geniuses at the FED decided they couldn’t let that happen again. So what’d they do? Instead of cracking down on Wall Street’s risky gambles on opaque derivatives, the FED decided to pump so much money to Wall Street that megabanks could continue to gamble effectively risk-free. And thus was born two key “tools” the FED has used with near reckless abandon since 2008: “Quantitative Easing” (QE) and “Overnight Repurchase Agreements” (Repo).

Wall Street on Parade has covered at length the FED’s latest abuses of Repo - using it to pump roughly $48 TRILLION in overnight cash loans to the trading arms of Wall Street and Foreign megabanks most overexposed to derivatives. Corporate media — now owned and controlled by Wall Street — has instituted a nationwide coverage blackout on the scandal. Perhaps the largest outlet to run an article about the FED’s “Repo Madness” is bitcoin.com. (https://news.bitcoin.com/report-feds-secret-repo-loans-to-megabanks-in-2020-eclipsed-2008-bailouts-data-dump-shows-48-trillion-in-stealth-funding/). Experts agree the FED vastly exceeded its legal authority and selectively bailed out failing financial firms in contravention of the Dodd-Frank Act.

The FED also acted beyond its legal authority in connection with trillions of QE purchases that brought the FED’s balance sheet to a staggering total of about $9 TRILLION. Instead of reasonably limiting those purchases to US Treasuries, the FED has been buying up trillions in residential MBS without apparent legal authority. As we’ve noted before, there is “no express provision in the Federal Reserve Act for the Federal Reserve to use its open market authority to purchase private sector promissory notes … Conversely, the plain meaning of Section 14 reveals that the Federal Reserve may not purchase private assets because they lack the requisite ‘full guarantee’ element required by the Federal Reserve Act.” Chad Emerson, More Illegal Actions of the Federal Reserve: How the Federal Reserve Acted Outside the Scope of Its Legal Authority in Purchasing Securities from Fannie Mae and Freddie Mac, 29 NO. 10 BANKING & FIN. SERVICES POL’Y REP. 11 (Oct. 2010).

Powell has tacitly admitted this lack of authority when suggesting the FED intends finally to shift to a balance sheet made up of mostly Treasury securities. Indeed, longtime former President of the Philadelphia Federal Reserve Bank, Charles Plosser recently agreed that the FED has exceeded its authority. Plosser has proposed (1) limiting the FED’s ability to purchase any assets other than U.S. Treasury Securities and (2) stripping the FED of its Section 13(3) emergency powers entirely.

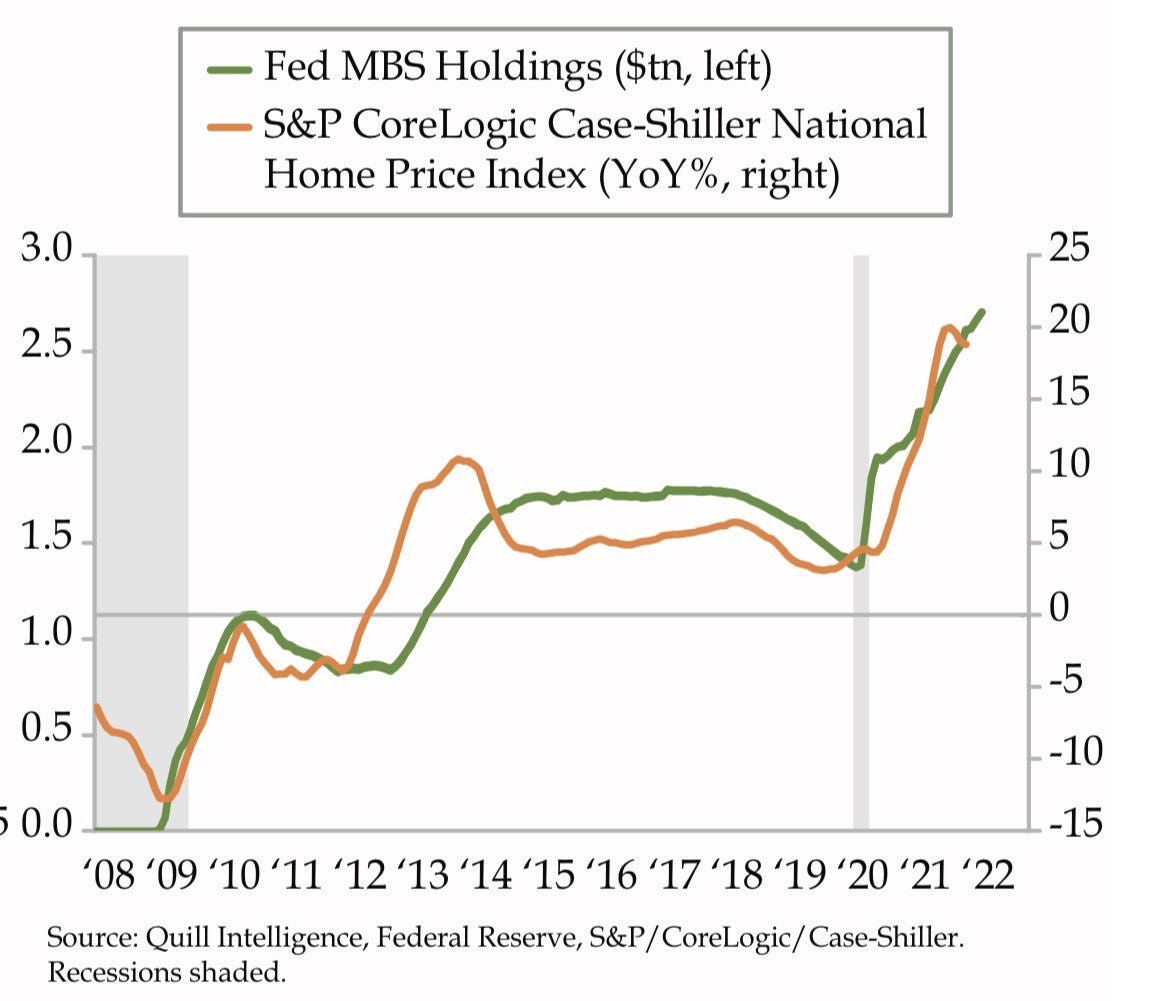

Of course, there is zero doubt as to what the FED wrought with its illicit foray into backstopping the entire MBS market. 20% or more housing inflation across the country (while the #CPLie still reports a mere 5.5%). The causal relationship between the FED’s purchases and housing inflation/unaffordability is crystal clear.

Why did the FED blow the housing bubble so hard? Because Wall Street private equity firms decided to frontrun the FED’s purchases by buying up not just MBS, but also affordable single-family houses. See, e.g. Slate’s “Investment Firms Aren’t Buying All the Houses. But They Are Buying the Most Important Ones.” And Jay Powell is a private equity guy above all else. See, e.g. “Jerome Powell’s Fed policies have boosted the system that made him rich” by Christopher Leonard. Powell literally worked as a Wall Street defense lawyer, private equity vulture at Carlyle Group, and now owns tens of millions in BlackRock proprietary securities. Powell, of course, infamously selected BlackRock in a no-bid process to manage the FED’s entire latest QE program.

So after the FED has blown the biggest everything bubble in history, what now? First, the bubble has already started to pop under its own weight. Market rates were soaring due to rampant inflation before the FED even started to raise the Fed Funds Rate. And now the FED will exacerbate things through outsized catch-up rate hikes with average mortgage rates already over 6%. Indeed, housing price cuts and inventory are starting to rise sharply.

But just so the crash isn’t quite so obviously the FED’s fault, they are also failing to reduce their MBS holdings. In June, the FED continued to buy more than $23 Billion in MBS, despite claiming they would institute a $17.5 Billion cap on purchases. Indeed, the FED’s MBS balance INCREASED for the month.

How is this possible? Or is the FED lying to the American people about QT? Well, FED apologists like former NY FED trader Joseph Wang claim this is all simply a function of MBS settlements taking 3 months.

The only problem with that theory, of course, is that the FED was supposed to stop buying MBS more than 3 months ago in March. We’d love to be wrong about all this. We’d love for Americans not to have to worry about what corrupt FED apparatchiks in DC and New York are doing. But sadly, such is not the world we live in now.

The FED has irrevocably breached the trust of the American people. The FED should never again be allowed to play God with American financial and housing markets. Everyone needs to start paying attention right now before it’s too late. And the most important thing we can do is to wake our family, friends and followers up to FED corruption - even if that means a deeper housing or stock market crash.

Enough is enough. What we need is a return to capitalism! Because what we have is clearly not it anymore. The centrally planned joke of a financial system we have now in America will take us all down in the long run.

-#OccupyTheFed

*Everything Occupy The Fed writes is for informational purposes only and represents the writers’ opinions based on publicly available information. Nothing we write is ever intended as, nor should it be relied upon as, investment advice. The best investment advice in this Golden Age of Fraud seems to be based on inside information from government officials, and we would never try to compete with that.

#1 The Fed partnered up with an outside entity for the first time ever.....Blackrock.

#2 The Fed bought 40,000 million of MBSs each month for a couple of years ($40 Billion) as housing prices spiked.

#3 Blackrock has big investments in residential real estate.

#4 In 2006 the Fed held no MBSs, now own 2.7 Trillion

#5 Don't think this is a coincidence

Fight the good fight every moment

Every minute every day...